DOGE Price Prediction: Analyzing Investment Potential Amid Technical Consolidation and ETF Catalyst

#DOGE

- Technical indicators show DOGE in consolidation below key moving averages with bearish MACD momentum

- Potential spot ETF approval by Grayscale represents significant fundamental catalyst

- On-chain revival and meme coin resurgence supporting broader market sentiment

DOGE Price Prediction

Technical Analysis: DOGE Shows Mixed Signals Amid Consolidation

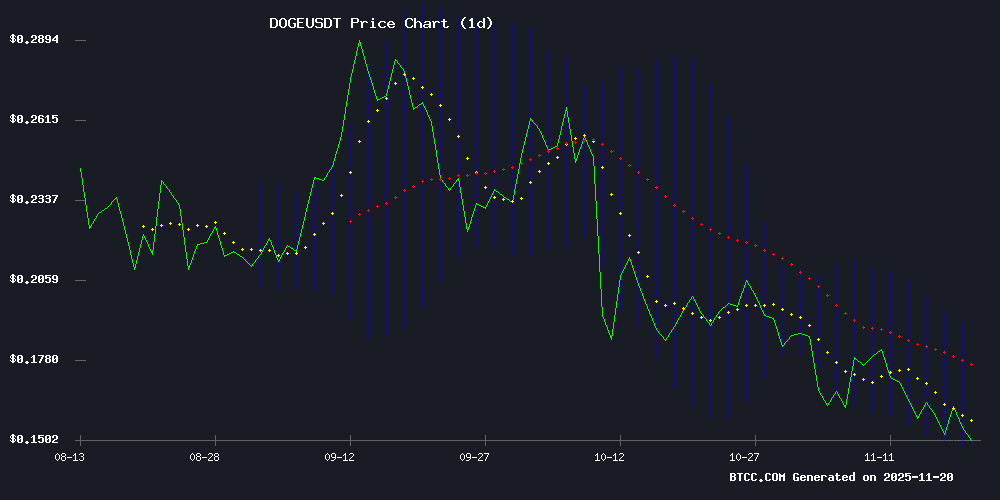

According to BTCC financial analyst John, DOGE is currently trading at $0.15735, below its 20-day moving average of $0.16797, indicating short-term bearish pressure. The MACD reading of -0.003781 suggests weakening momentum, though the price remains within the Bollinger Bands range of $0.147341 to $0.188599. John notes that the current position NEAR the lower band could signal a potential rebound if support holds.

Market Sentiment: Positive Catalysts Emerge for Dogecoin

BTCC financial analyst John observes that recent developments, including the potential launch of the first spot Dogecoin ETF led by Grayscale and ongoing on-chain revival, are generating positive market sentiment. However, John cautions that these fundamental developments should be viewed in context with the current technical picture, suggesting that while long-term prospects appear favorable, short-term volatility may persist.

Factors Influencing DOGE's Price

Dogecoin's On-Chain Revival Sparks Meme Coin Resurgence

Dogecoin's net position change and Money Flow Index (MFI) suggest accumulating interest, with institutional eyes locked on Grayscale's upcoming DOGE-tracking ETF. The meme coin's MFI lingers NEAR 40—a historical accumulation zone—while outflows slow, hinting at potential reversal momentum.

Beyond DOGE, new meme coins like Maxi Doge and PEPENODE gain traction. Maxi Doge merges high-leverage trading with staking and treasury mechanics, while PEPENODE's mine-to-earn model gamifies node operations. These projects thrive as capital rotates toward riskier assets.

Grayscale's ETF launch could catalyze fresh demand. Meanwhile, large holders absorb liquidity instead of dumping, reinforcing the bullish technical setup. The market watches for FOMO to ignite the next leg up.

First Spot Dogecoin ETF Nears Launch with Grayscale Leading the Charge

Dogecoin is poised to join the ranks of cryptocurrencies with U.S.-listed exchange-traded funds, as Grayscale's updated filing signals an imminent launch. The SEC's fast-track rules have set a 20-day countdown, with analysts projecting a debut as early as November 24.

Grayscale's strategic positioning underscores institutional confidence in DOGE. Bloomberg's Eric Balchunas notes, "Based on the 20-day clock, Grayscale will likely launch the first DOGE ETF by 11/24." This accelerated timeline defies earlier expectations of a prolonged approval process.

The ETF's arrival marks a pivotal moment for meme coins seeking mainstream financial legitimacy. Market observers anticipate heightened volatility in DOGE markets as traders position ahead of the listing.

Dogecoin ETF Approval Imminent: Last Chance to Buy DOGE Under $0.20?

Dogecoin stands at the threshold of mainstream financial adoption as Grayscale's spot ETF nears automatic approval under SEC rules. The 20-day countdown concludes on November 24, 2025, potentially unleashing institutional demand for the meme coin that's already captured corporate interest.

Nasdaq-listed BitOrigin's $500 million DOGE position signals growing institutional confidence. Bloomberg's Eric Balchunas notes the SEC's Generic Listing Standards appear to favor approval, with competing products from Bitwise and 21Shares likely to follow Grayscale's lead.

The impending ETF launch raises questions about Dogecoin's valuation floor, with analysts suggesting current prices below $0.20 may soon become inaccessible to retail investors. Market watchers anticipate fresh capital inflows could reshape DOGE's liquidity profile and volatility patterns.

Is DOGE a good investment?

Based on current technical indicators and market developments, DOGE presents a mixed investment case. The technical analysis shows the cryptocurrency trading below key moving averages with negative MACD momentum, suggesting near-term caution. However, the potential approval of a spot ETF and renewed on-chain activity provide fundamental support for longer-term growth.

| Metric | Current Value | Interpretation |

|---|---|---|

| Current Price | $0.15735 | Below 20-day MA |

| 20-day MA | $0.16797 | Resistance level |

| MACD | -0.003781 | Bearish momentum |

| Bollinger Lower Band | $0.147341 | Potential support |

| Bollinger Upper Band | $0.188599 | Potential resistance |

Investors should consider their risk tolerance and investment horizon, as the ETF catalyst could significantly alter the price trajectory if approved.